I generally dislike writing about Prime Day (or Black Friday, etc.), or any Amazon sales or deals because I don’t see the job of this newsletter as helping Amazon move products, even (or especially) when they’re things I use and like. I’m not an Amazon expert or watcher in that sense, at least not professionally.

But you really cannot deny that Amazon has been largely successful in turning Amazon Prime Day(s) into a media event, at least for online media, and to some extent to television as well. Online news covers the sales, both as service journalism (here’s what to buy, from Amazon or elsewhere), and as a business event (here’s how Prime Day sales met/beat/fell below expectations, and what that means for Amazon’s stock/online retail). And both of those kinds of stories push commerce for (and interest in) Amazon.

Social media, too, drives Prime Day sales, as people share deals they’ve found (or less often, warn their readers away from a sale that looks generous, but really isn’t).

The trouble with Prime Day, though, is that the sales can change in real time. Deals unveiled one day can expire before the day’s over, or sometimes before noon. So even the sites recommending a sale can get burnt if Amazon runs out of product or decides (for whatever reason) to end or change the discount.

Here’s an example. The New York Times/Wirecutter’s post “The Prime Day Deals Wirecutter Staffers Have Actually Bought” updated several times before wrapping up at the end of June 22. (Forgive me, I don’t have screenshots, but you can see that the story has been updated and there’s an editors’ note declaring that “As Prime Day 2021 winds down, we’ve stopped updating this post and can’t guarantee that all deals are still in stock.”)

At one point on June 21st, this story recommended a Zojirushi thermos, on sale for less than $20. I know, because I bought it. I also know that shortly after I bought it, I refreshed the page to send the link to someone else and saw that the price had changed: now it cost closer to $30. The sale had ended without warning or fanfare.

This is different from a Black Friday blockbuster sale. Those are also driven by media attention and false scarcity, but you can usually be fairly sure that if the item advertised is available, it will be available at the sale price, and not some other price algorithmically adjusted when it’s become clear that the new price is moving too many units and a thicker margin is possible.

To me, that’s what’s ultimately so uncanny about Prime Day: the instability of all of it. The timing, the prices, the links, the influencers and affiliates helping to drive the sales, the retail partners willing to participate (but only so far), even the media attention. It feels like The Music Man, with Harold Hill breezing into town offering deals on musical instruments.

Here’s one problem. The sale itself is so big, especially when you factor in competing sales from other retailers, it’s too difficult to navigate. So there actually is some value in specialist sites like the Wirecutter helping to identify the best deals. But ultimately, the sale is so volatile, with deals changing by the hour, that the “what to buy” links as often as not dump you back on the retailers’ own homepages.

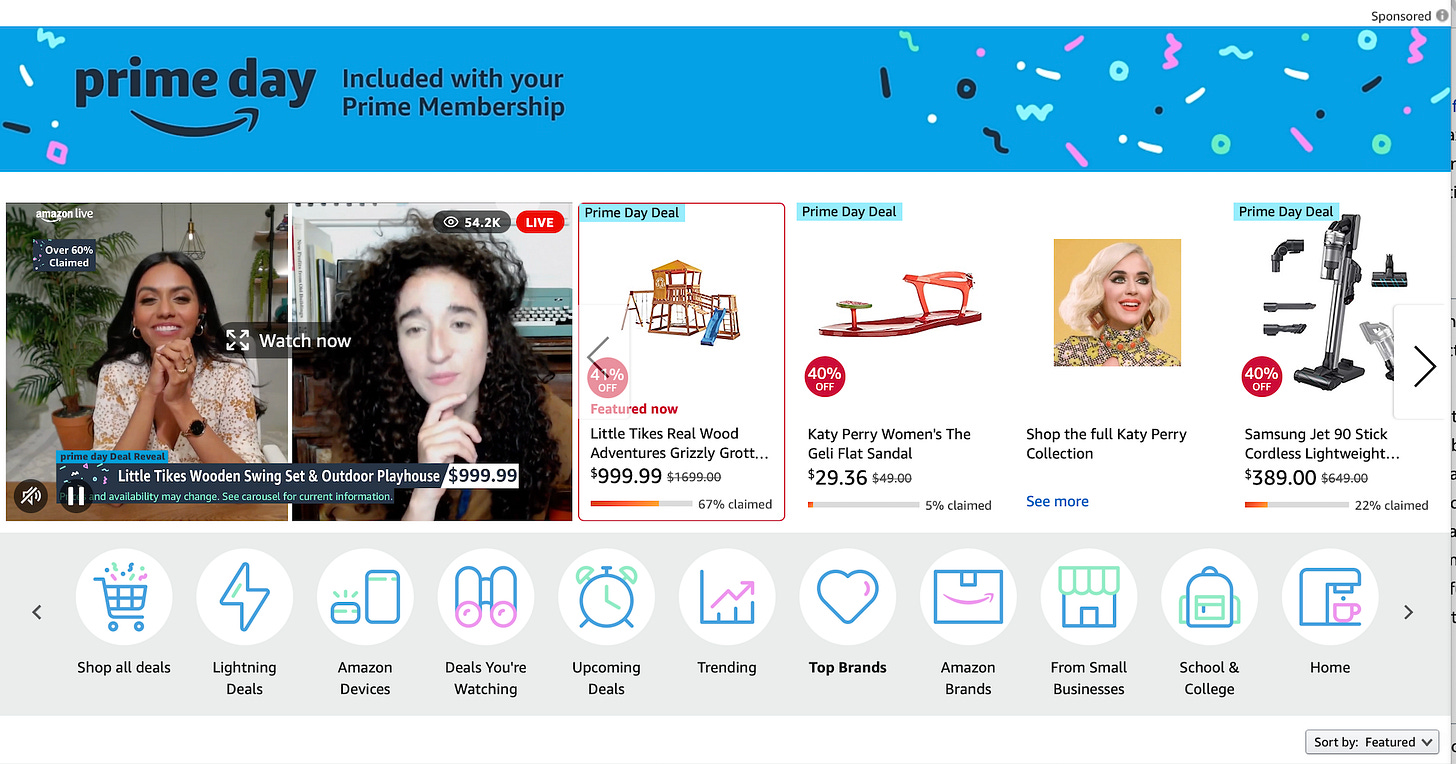

The Amazon homepage during Prime Days is now itself organized as a media event. There’s an autoplaying livestream of Amazon-approved influencers pushing particular deals, like a mildly updated version of a late-night infomercial crossed with the Home Shopping Network. There are countdowns to deals that will only be fully active later. There’s an insistent demand for attention, but it’s not a constant attention, more like an ambient attention, the same way a social media timeline or casual mobile game is continually pinging you to open it, knowing and promising that you can put it down at any time.

It’s a big funnel, or an inverted pyramid. And while Amazon needs other brands to participate, and other websites (whether they’re benefitting from affiliate sales fees or not) to help drum up interest (and to some extent, even the competing sales ultimately help drum up interest in retail on those dates), the real driver is Amazon’s own site and the deals it offers on its own products, which it pushes very successfully.

But this feels only quasi-stable. It depends on slow news, slow sales, an abundance of attention. Constantly monitoring the site for deals that have already been recommended (but which have been later pulled) takes more labor than most news sites are willing to spend on a story that’s supposed to be a quick freebie.

I would guess that in the future, either the sales themselves will stabilize (even if, like on Black Friday doorbusters, they limit themselves to N per customer or for a predetermined limited time) or the media partners Amazon relies on to help drive attention will focus on recommendations they can guess will be reliable to the end of the sale. It’s okay for the festival to run through, but you want some idea of how things will go from start to finish.

The alternative is that the show will increasingly start and finish at Amazon’s home page itself, which will (ideally) get better and better at recommending its own sales to its customers, whether those products are Amazon-branded or not. The home page will find more, better, and different ways of attracting attention: perhaps some kind of bundled entertainment package on Prime Day(s), in the manner of a public media pledge drive, with a mix of eye-catching performances and sales. It will become more of a self-contained extravaganza and less of a distributed one. And, ultimately, that might end up being better for everybody.